Fintechzoom Meta Stock: The Story Behind Meta’s Market Fluctuations

In the ever-evolving landscape of technology and finance, fintechzoom meta stock emerges as a beacon for savvy investors. As a hub for cutting-edge financial insights, fintechzoom not only demystifies the complex interplay between emerging tech sectors and stock market dynamics but also offers a tailored guide for those eyeing investments in meta technologies. In a world where digital realities increasingly intersect with financial strategies, understanding fintechzoom’s nuanced analysis can be the key to unlocking potential in the high-tech investment sphere.

What is Fintechzoom Meta Stock?

Once upon a time in the bustling world of financial technology, a new player emerged on the scene, captivating investors and tech enthusiasts alike. This newcomer, known affectionately as fintechzoom meta stock, isn’t just another ticker symbol on the stock exchange; it represents a revolution in how we view and interact with financial data.

Fintechzoom meta stock isn’t a company itself but rather a spotlight shining on Meta Platforms, Inc., formerly known as Facebook. The term “Fintechzoom” refers to a popular financial news and services platform that provides insights, analysis, and up-to-the-minute information on various stocks, including Meta. So, when someone mentions fintechzoom meta stock, they’re diving into the world of Meta’s stock as seen through the lens of Fintechzoom’s comprehensive financial ecosystem.

This coverage is crucial because Meta Platforms, Inc. stands as a colossal in the tech industry, with its vast networks spanning across Facebook, Instagram, WhatsApp, and Oculus. The company’s innovations in digital advertising and its strides toward building an immersive virtual reality have kept investors glued to their screens, watching every dip and rise in its stock with bated breath.

Understanding Mate’s Market Position

As our narrative unfolds, we dive deeper into the realm of fintechzoom meta stock, exploring the strategic position of Meta Platforms, Inc. within the fiercely competitive tech market. This journey isn’t just about numbers and charts; it’s about understanding the pulse of a giant that shapes how billions of people connect and communicate.

Meta, with its diverse array of platforms, has been a cornerstone in the digital realm for years. Its market position is unique, primarily because it operates at the intersection of technology, media, and community building. The company’s ability to adapt and innovate in response to changing digital landscapes is nothing short of legendary.

In the realm of social media, Meta stands as a titan. It’s not just about the number of users, which by itself is staggering, but about how deeply integrated these platforms are in the daily lives of users. Facebook and Instagram are not merely apps but ecosystems that host businesses, communities, and even social movements.

Beyond social media, Meta’s ventures into virtual reality and augmented reality, particularly through its Oculus devices, underscore its ambition to lead the next technological revolution—what it calls the “metaverse.” This futuristic vision of a fully immersive digital world could redefine human interaction, and Meta aims to be at its forefront.

However, the path isn’t devoid of obstacles. Competition from other tech giants, regulatory pressures, and changing public perceptions about privacy and data security are significant challenges. Through the lens of Fintechzoom Meta Stock, investors watch closely how Meta navigates these waters, maintaining its dominance while pushing the boundaries of innovation.

The Intersection Of Fintechzoom And Meta Stock

In our ongoing saga of fintechzoom meta stock, we now explore the intriguing crossroads where Fintechzoom and Meta’s paths intertwined, a junction rich with insights and opportunities for investors. This intersection is more than a mere overlap of financial interests; it’s a vibrant hub of analytical prowess and strategic forecasting.

Fintechzoom, as a platform, excels in distilling complex financial data into actionable intelligence. When it comes to Meta stock, Fintechzoom’s coverage is comprehensive. The platform does not just track the stock price movements; it delves into the why and how—analyzing earnings reports, market trends, and even the broader economic indicators that influence Meta’s performance.

This convergence provides a unique advantage for both novice investors and seasoned financiers. Fintechzoom’s analytical tools allow users to gauge Meta’s stock performance within the broader context of the tech industry and global markets. This is particularly valuable in today’s fast-paced market environment, where understanding the nuances of a stock’s performance can make or break investment decisions.

How FintechZoom Analyzes Meta Stock

As we delve deeper into the intricacies of Fintechzoom and Meta’s entwined narrative, it becomes essential to uncover the methodology behind FintechZoom’s keen analysis of Meta stock. This part of our journey sheds light on the sophisticated techniques and sharp insights that transform raw data into a clear-cut strategy for investors.

FintechZoom employs a multifaceted approach to stock analysis that is both thorough and nuanced. At the heart of its methodology lies a robust combination of fundamental and technical analysis, enriched with sentiment analysis to gauge the mood of the market.

Fundamental Analysis

FintechZoom starts with the basics: fundamental analysis. This involves a deep dive into Meta’s financial health. Analysts scrutinize quarterly earnings reports, revenue streams, and profitability metrics. They also consider the company’s long-term strategies, management effectiveness, and market position. This fundamental analysis provides a solid foundation, highlighting the company’s intrinsic value and potential for growth.

Technical Analysis

Next, FintechZoom incorporates technical analysis, which uses historical market data and stock price trends to predict future movements. By examining patterns in Meta’s stock price fluctuations, volume changes, and other market indicators, FintechZoom identifies potential entry and exit points for investors. This analysis is particularly appealing to those who seek to capitalize on short-term price movements.

Sentiment Analysis

Perhaps the most cutting-edge aspect of FintechZoom’s approach is sentiment analysis. Here, the platform evaluates how public perceptions, news events, and social media trends are affecting investor behavior towards Meta stock. This method is crucial in today’s digital age, where information spreads rapidly and can have immediate impacts on stock prices.

Benefits of Using FintechZoom for Meta Stock

As we continue our exploration into the world of Fintechzoom and its analysis of Meta stock, it’s time to highlight the tangible benefits that investors can reap by utilizing this resourceful platform. This segment of our narrative not only illustrates the advantages of informed decision-making but also underscores how Fintechzoom enhances investment strategies with precision and foresight.

Timely and Accurate Information

One of the primary benefits of using Fintechzoom for monitoring Meta stock is the access to timely and accurate financial information. Fintechzoom’s platform is designed to provide real-time updates and deep dives into Meta’s financial health, market trends, and potential investment risks. This immediacy and precision of information are invaluable in a market where timing can be the difference between profit and loss.

Comprehensive Market Analysis

Fintechzoom offers a holistic view of the market. By integrating fundamental, technical, and sentiment analysis, the platform provides a rounded perspective that goes beyond traditional stock evaluation methods. This comprehensive analysis helps investors understand not just what is happening with Meta stock, but why it’s happening, enabling them to anticipate market movements rather than just react to them.

Expert Insights and Predictions

Another significant benefit is the access to expert insights and predictive analytics. Fintechzoom’s team of financial analysts brings expertise and seasoned judgment to their coverage of Meta stock. These insights, combined with advanced analytical tools, offer predictions about future trends and potential market shifts, giving subscribers an edge in their investment planning.

Strategic Investment Planning

Using Fintechzoom can significantly enhance strategic investment planning. The platform’s analyses help investors identify the right moments to buy or sell Meta stock, based on their individual investment goals and risk tolerance. This strategic guidance is particularly beneficial for those who may not have the time or expertise to analyze such a complex market on their own.

Educational Resources

Lastly, Fintechzoom serves as an educational hub for investors who wish to learn more about the stock market mechanics. With articles, tutorials, and real-time case studies like those involving Meta stock, users can deepen their understanding of financial markets and better equip themselves for future investment decisions.

Recent Financial Performance

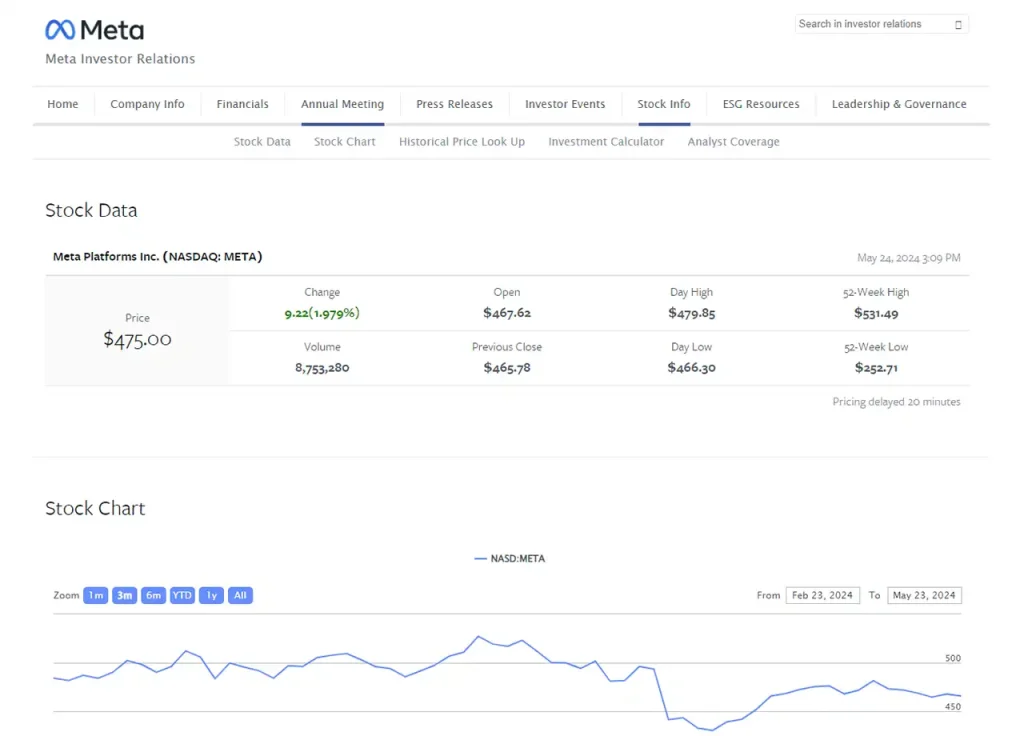

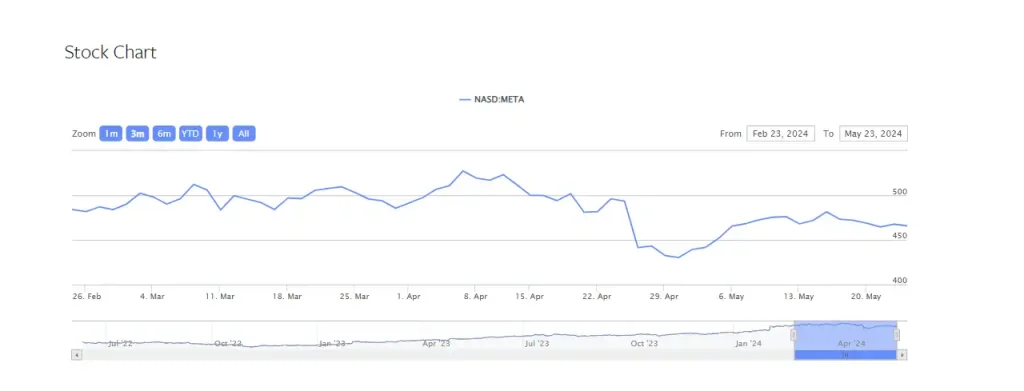

As we pivot to examining the recent financial performance of Meta Platforms, Inc., we delve into a critical aspect of our ongoing tale that reveals the current state of this tech giant. Through the lens of FintechZoom’s meticulous analysis, we can better understand how Meta’s stock has weathered economic fluctuations and navigated the dynamic tech landscape.

A Snapshot of Recent Earnings

In recent quarters, Meta has demonstrated a resilient financial performance, marked by robust revenue growth despite the challenges posed by a competitive digital advertising market and global economic uncertainties. The company has continued to leverage its massive user base across platforms like Facebook and Instagram, capitalizing on innovative advertising solutions that cater to a diverse range of businesses.

Impact of Strategic Decisions

A key component of Meta’s recent financial narrative has been its strategic pivots and investments, particularly in areas like artificial intelligence and virtual reality. These initiatives are part of Meta’s broader vision to transition from a social media company to a metaverse company. While these investments have incurred significant costs, they are anticipated to play a crucial role in shaping the company’s future growth trajectory.

Profitability and Revenue Streams

Despite the heavy investments in new technologies, Meta has maintained a strong profitability profile. Its ability to generate revenue not just from advertising but also from other ventures like hardware sales and payment services illustrates the company’s adeptness at diversifying its revenue streams. This diversification is a critical factor in sustaining its financial health and supporting its ambitious growth plans.

Market Response and Investor Sentiment

The market’s response to Meta’s recent financial performance has been mixed. On one hand, investors are encouraged by the company’s revenue growth and its strategic positioning for future tech evolutions. On the other hand, there is cautiousness around the substantial investments in the metaverse, with stakeholders keenly watching how these bets turn out.

Conclusion

As we draw the curtains on our exploration of fintechzoom meta stock, it’s clear that this intersection of finance and technology offers a fascinating glimpse into the future of investing. Through Fintechzoom, investors gain access to invaluable insights that demystify Meta’s complex market dynamics and guide strategic decision-making. The platform’s comprehensive analysis, from fundamental reviews to expert forecasts, empowers users to navigate the volatile tech stock landscape with confidence and precision.

Whether you’re a seasoned investor or a newcomer eager to understand the nuances of tech investments, Fintechzoom provides the tools and knowledge needed to make informed choices. In the world of fast-evolving technology and financial markets, staying informed is not just an advantage—it’s a necessity. And with resources like Fintechzoom, the journey through the intricacies of Meta stock not only becomes manageable but also strategically rewarding.