Are Tariffs Good or Bad? Their Impact on the Economy in 2025, Trade, and Business

I’ve spent years researching how tariffs shape economies, influence trade, and impact the daily lives of people across the globe. To many, tariffs might seem like a distant government policy, something decided in political offices with little connection to everyday reality. But I’ve seen how these taxes on imports can influence the price of your groceries, the clothes you wear, and even the stability of local jobs.

From the US–China trade war to shifts in global supply chains, I’ve studied the winners who thrive under tariff protection and the industries that struggle when costs rise. The truth is, the question “Are tariffs good or bad?” has no simple answer. They can protect and strengthen, but they can also disrupt and burden. In this article, I’ll guide you through how tariffs work, their different forms, and their real-world consequences so you can clearly understand how one policy decision can ripple through economies and directly affect you.

What Are Tariffs?

Tariffs are a type of tax that a government puts on goods coming from other countries. Imagine you buy a car from another country. Before it can be sold in your country, the government might add an extra cost to it. That extra cost is the tariff. Governments use tariffs for different reasons. Sometimes it’s to protect local businesses from cheaper products made abroad. Other times, it’s to collect more money for the country. In some cases, tariffs are used to encourage people to buy locally made products instead of imports.

For example, if imported shoes are much cheaper than local ones, a tariff can make the imported shoes more expensive. This gives local shoe makers a better chance to compete. But tariffs don’t just affect businesses; they can also change the prices we pay for everyday things. When people ask, “are tariffs good or bad,” it often comes down to how they impact daily life and the economy. I remember reading about tariffs during the trade tensions between the United States and China. Everyday items like electronics, clothes, and even toys saw price changes. It made me realize how something that sounds like a technical government decision can have a direct impact on what we pay at the store.

Different Types of Tariffs

- Import tariff: A tax placed on goods coming into the country from abroad. Example: an extra charge on imported cars or furniture to protect local businesses.

- Export tariff: A tax on goods leaving the country, often used to keep important items, like food or raw materials, available for local use.

- Specific tariff: A fixed amount charged on each unit of a product, such as $5 on every imported T-shirt.

- Ad valorem tariff: A percentage of the product’s value, like 10% of a car’s price.

- Compound tariff: A combination of a fixed amount and a percentage, for example, $3 plus 5% of the product’s value.

How Tariffs Work and Who Pays Them

Tariffs work by adding a tax to goods that are imported into a country. When a shipment arrives at the border or port, customs officials calculate the tariff based on either the value of the goods (a percentage) or a fixed amount per unit. The importer, usually a business that brings the goods into the country, is responsible for paying this tax to the government before the products can be sold.

Although importers officially pay the tariff, the cost often gets passed along to others. Businesses may raise their prices to cover the extra expense, which means consumers end up paying more when they buy the product. For example, if a retailer imports electronics from another country and has to pay a tariff, the final price on store shelves is likely to increase.

Sometimes, domestic manufacturers benefit because the higher price of imported goods makes their products more competitive. However, for industries that depend on imported materials or components, tariffs can raise production costs, making it harder for them to keep prices low. This is why the question “are tariffs good or bad” often depends on perspective. In reality, tariffs are not just about who pays the tax at the border. They can ripple through the entire economy, influencing prices, supply chains, and even the choices people make when shopping.

Why Some People Think Are Tariffs Good or Bad

People’s opinions on are tariffs good or bad often depend on how they are affected by them. Those who see tariffs as a good thing believe they protect local industries from being pushed out by cheaper foreign goods. By making imported products more expensive, tariffs can help local businesses stay competitive, keep jobs in the country, and encourage consumers to buy locally made products. Some also see tariffs as a way for the government to earn extra revenue that can be invested in public services and infrastructure.

On the other hand, many people think tariffs are bad because they can make everyday goods more expensive. When businesses pay higher taxes on imports, they usually pass that cost on to shoppers. This means families might spend more on clothes, electronics, cars, or even food. Tariffs can also limit the variety of products available in stores, as some imports may become too costly or even disappear from the market.

For businesses that rely on imported raw materials, tariffs can raise production costs, making it harder to compete at home and abroad. In addition, tariffs can lead to trade disputes if other countries respond with their own taxes on exports. This can hurt exporters, slow down trade, and create uncertainty in the economy.

Are Tariffs Good or Bad for the US Economy

Tariffs in the United States have been a debated tool for shaping trade and protecting domestic industries. Supporters see them as a way to shield American manufacturers from cheaper foreign competition. By adding taxes to imported goods, tariffs can encourage people to buy products made in the US, helping to keep money within the country and preserve jobs. They can also provide the government with extra revenue, which can be spent on infrastructure, education, and public programs.

However, tariffs can also have downsides for the US economy. When the cost of importing goods rises, businesses often pass that extra expense on to consumers. This can make everyday items such as electronics, clothing, and food more expensive. Industries that rely on imported materials may also face higher production costs, which can make it harder for them to compete both at home and abroad.

Tariffs have at times led to trade disputes, as seen during the US–China trade tensions, where both sides imposed taxes on each other’s goods. This disrupted supply chains and created uncertainty for businesses. In the end, whether are tariffs good or bad for the US economy depends on the specific industries affected, the goals of trade policy, and how other countries respond. They can offer short-term protection but may also bring long-term challenges.

Are Tariffs Good or Bad for the Economy in 2025?

In 2025, the debate over tariffs continues to shape economic policies and global trade. Supporters argue that tariffs remain an important tool for protecting local industries from being flooded with cheaper imports, especially in manufacturing, agriculture, and technology. By making foreign goods more expensive, tariffs can encourage consumers to buy domestic products, which supports local jobs and keeps money circulating within the country. Governments also benefit from the tax revenue tariffs generate, which can be invested in public projects and services.

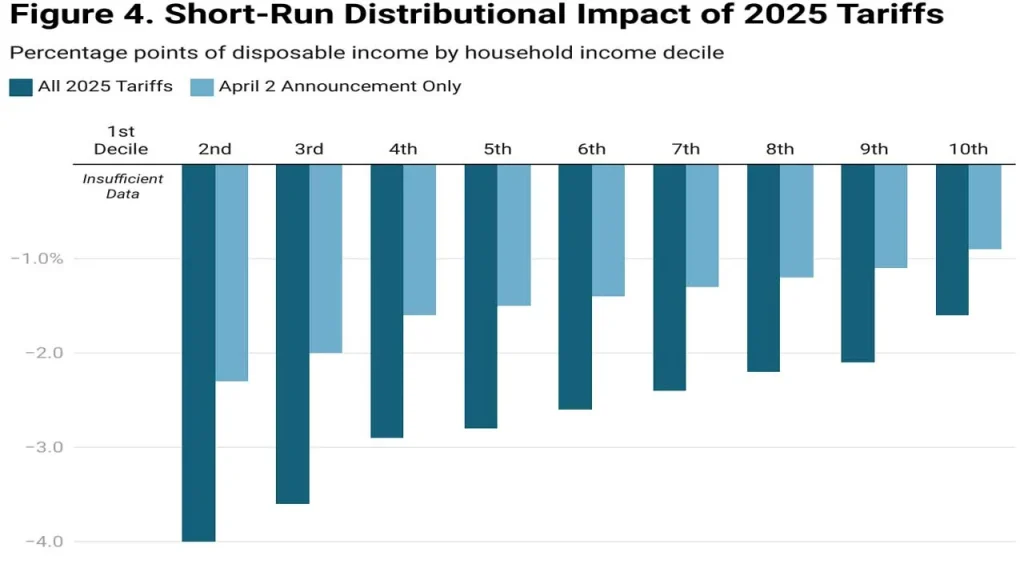

However, the global economy in 2025 is more interconnected than ever, and tariffs can bring significant downsides. Businesses that rely on imported raw materials or components face higher production costs, which often lead to higher prices for consumers. This can slow spending, increase inflation, and reduce purchasing power for households. Tariffs can also disrupt international supply chains, making it harder for companies to operate smoothly and meet demand.

Another concern in 2025 is the potential for trade disputes. When one country imposes tariffs, others may retaliate, limiting export opportunities and creating uncertainty in the market. This uncertainty can affect investments, job growth, and long-term business planning. While tariffs can offer short-term protection to certain sectors, they may also slow overall economic growth if applied too broadly or for too long. The challenge lies in finding a balance between protecting local industries and keeping trade open in a globalized economy.

Are Tariffs Good or Bad for the Stock Market

Tariffs can influence the stock market in both direct and indirect ways. When tariffs are announced, investors often react quickly because they can change the outlook for certain industries. For example, companies that rely heavily on imported goods or raw materials may see their costs rise, which can lower profits and cause their stock prices to fall. On the other hand, domestic companies that face less competition from foreign imports might benefit, and their shares could go up.

The overall stock market can also be affected by how tariffs influence investor confidence. If tariffs lead to trade disputes or economic slowdowns, investors may become cautious and sell off stocks, leading to market declines. This was seen during the US–China trade tensions, when tariff announcements sometimes triggered large swings in major stock indexes.

However, tariffs don’t always have a negative effect. In some cases, they can boost sectors like steel, manufacturing, or agriculture if those industries gain protection from cheaper foreign competition. Still, the benefits are usually limited to specific companies or sectors, while the broader market may remain uncertain.

Are Tariffs Good or Bad for Business and Trade

For Business

For some businesses, tariffs can act as a form of protection against low-cost foreign competition. When imported goods become more expensive due to tariffs, local companies can compete more easily on price. This can help them grow, protect jobs, and invest in better production. For industries like steel or textiles, tariffs can provide the breathing room needed to survive in a competitive global market.

On the other hand, many businesses face challenges when tariffs are introduced. Companies that depend on imported raw materials or parts often have to pay more, which raises production costs. These higher costs can reduce profits or force businesses to raise prices, which might make their products less appealing to customers. For exporters, tariffs from other countries in retaliation can also shrink their overseas markets.

For Trade

Tariffs can slow down the flow of goods between countries. When one nation imposes tariffs, other nations may respond with their own, leading to a trade dispute. This back-and-forth can disrupt supply chains, make certain goods harder to get, and increase the overall cost of doing business internationally.

In industries where countries rely on each other for parts, materials, or products such as manufacturing, technology, and agriculture tariffs can create delays and uncertainty. While they might protect some local industries in the short term, over time they can limit growth opportunities and weaken relationships between trading partners.

The Good and Bad Impact of Tariffs

Tariffs can bring both positive and negative effects, and their impact often depends on who you are and what industry you’re in. On the positive side, tariffs can protect local industries from being undercut by cheaper foreign products. This protection can help keep factories running, save jobs, and encourage investment in domestic production. In some cases, tariffs also motivate consumers to buy locally made goods, which keeps more money circulating within the country. Governments benefit too, as tariffs generate additional tax revenue that can be used for public services.

On the negative side, tariffs often lead to higher prices for consumers. When the cost of importing goods goes up, businesses usually pass that extra cost onto shoppers. This can make everyday items, from electronics to clothing to groceries, more expensive. Tariffs can also create problems for industries that rely on imported raw materials or components, as their production costs rise and profits shrink.

Another drawback is the risk of trade disputes. When one country imposes tariffs, others may respond with their own, reducing export opportunities and disrupting supply chains. This can hurt global trade and create uncertainty for businesses. In the long run, while tariffs can offer short-term protection for some industries, they may also slow economic growth and limit consumer choice.

Tips for Understanding the Good and Bad Impact of Tariffs

- Identify who benefits and who faces challenges when tariffs are introduced.

- If you work in or support industries competing with foreign imports, tariffs may offer price protection.

- If your business or household depends on imported goods or materials, tariffs could lead to higher costs.

- Monitor how tariffs affect prices over time, as the initial impact might be small but can grow as supply chains adjust.

- Be aware that businesses often pass tariff costs to consumers, raising prices for everyday items.

- Consider the broader economic picture: tariffs can protect jobs but may also reduce export opportunities if other countries retaliate.

- Understand that tariffs involve trade-offs, which is why they are rarely entirely good or entirely bad.

Are Trump’s Tariffs Good or Bad

Donald Trump’s tariffs, introduced during his presidency starting in 2018, became one of the most talked-about trade policies in recent history. Supporters argue that these tariffs were designed to protect American manufacturing, reduce the trade deficit, and push trading partners, especially China, toward fairer trade practices. By placing tariffs on imported steel, aluminum, and a wide range of Chinese goods, the administration aimed to revive industries that had been losing ground to cheaper foreign competition. Some US companies in protected sectors saw short-term gains, and the policy appealed to those who wanted to bring more jobs back to America.

However, critics point out that Trump’s tariffs also raised costs for US businesses that relied on imported materials and goods, which in turn led to higher prices for consumers. The tariffs triggered retaliatory measures from other countries, hitting American exports such as soybeans and manufactured goods. This led many to revisit the question: are tariffs good or bad for the US economy? While some industries benefited, others, especially agriculture and export-heavy sectors, faced significant losses. In the end, Trump’s tariffs left a mixed legacy, showing both the potential and the risks of aggressive trade policies.

Real-Life Examples of Tariffs

One well-known example is the US–China trade war that began in 2018. The United States placed tariffs on hundreds of billions of dollars’ worth of Chinese goods, aiming to reduce the trade deficit and protect American industries. China responded with its own tariffs on American products such as soybeans, cars, and electronics. This back-and-forth raised costs for businesses on both sides and created uncertainty in global markets. Some US farmers struggled to sell their crops overseas, while certain American manufacturers benefited from reduced competition from Chinese imports.

Another example comes from the European Union, which has placed tariffs on goods like steel and aluminum imports. These were partly introduced to protect European industries from cheap imports that could harm local producers. While they helped some manufacturers stay competitive, they also made raw materials more expensive for other businesses. In 2020, India increased tariffs on certain electronics and mobile phone components to encourage more local production. This move boosted domestic manufacturing but also raised prices for consumers in the short term.

Conclusion

In conclusion, the debate over whether are tariffs good or bad remains complex, with no one-size-fits-all answer. Tariffs can provide valuable protection for local industries, support domestic jobs, and generate revenue for the government. They can also encourage consumers to buy locally made products, which strengthens the national economy. However, the downsides are equally significant. Higher import costs often lead to increased prices for everyday goods, limit product variety, and can trigger trade disputes that harm exporters.

For businesses relying on imported materials, tariffs can raise production expenses and reduce competitiveness. In a globally connected economy like 2025, the impact of tariffs depends on the industries involved, the size of the tariffs, and how other nations respond. While they can be a useful tool in certain situations, overuse or poorly targeted tariffs may slow economic growth. Understanding both the advantages and drawbacks is key to making informed decisions about their role in the economy.