Cloud-Based Accounting vs. Traditional: What’s the Difference?

Managing finances can be a challenge, especially when it feels like the tools you’re using are stuck in the past. If you’ve been thinking about switching from traditional accounting methods to a cloud-based accounting system, you’re not alone. But what exactly sets these two approaches apart, and how do you decide which is right for your business?

The Basics of Traditional Accounting

First, let’s look at how traditional accounting works. You’re probably familiar with the setup: everything is handled on-premise, using desktop software or even pen-and-paper ledgers. It’s the method that’s been used for decades, and while it’s reliable, it has its limitations.

One of the biggest drawbacks? Accessibility. With traditional accounting, your data is stored locally—either on your office computer or in physical files. Need to check a number while you’re out of the office? You’re out of luck. Updates can also be a pain, requiring manual installations or even help from IT support. Plus, traditional systems often require significant upfront costs for software licenses and server maintenance.

For some businesses, sticking with traditional methods feels safe and familiar. But is it holding you back?

Why Cloud-Based Accounting Stands Out

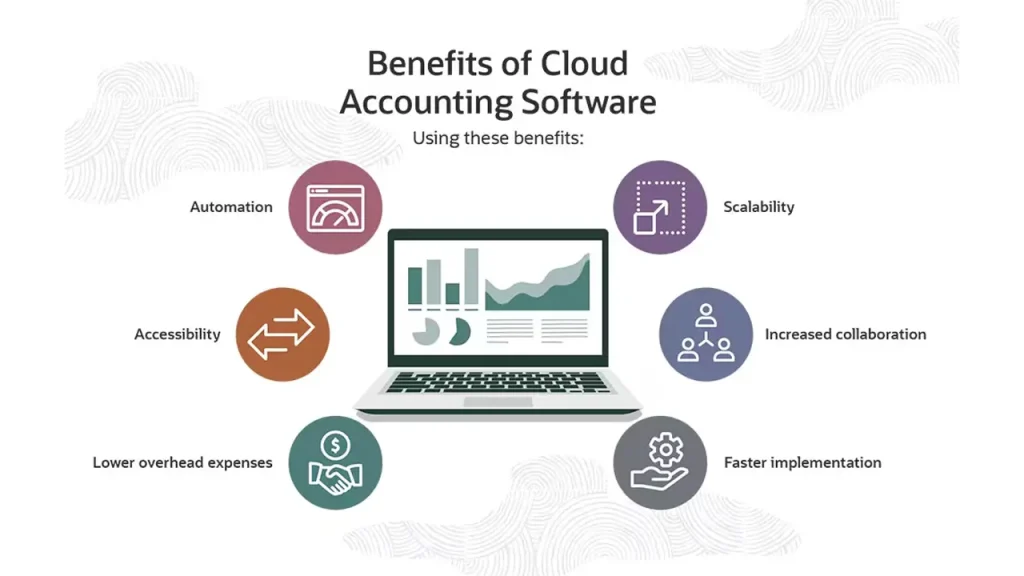

Enter cloud-based accounting, a more modern approach that operates entirely online. Instead of storing your data on a single device, everything is hosted in the cloud, accessible from any internet-connected device. Whether you’re at home, traveling, or working from a coffee shop, your financial information is always within reach.

Cloud based accounting for small businesses can be particularly game-changing. Imagine being able to send invoices, reconcile accounts, and track expenses in real time, no matter where you are. For small business owners who wear many hats, this kind of flexibility is a game changer.

Another huge perk? Updates happen automatically. No more worrying about outdated software or expensive upgrades—cloud providers handle all of that behind the scenes. And because your data is stored on secure servers, it’s protected against physical damage like floods or fires that could wipe out local records.

Comparing the Costs: Traditional vs. Cloud

Cost is often a deciding factor when choosing between traditional and cloud-based accounting. Traditional systems typically involve high upfront costs. You’ll pay for the software license, hardware, and sometimes even IT support to get everything set up. Ongoing costs, like server maintenance and manual upgrades, can add up quickly.

Cloud-based accounting flips that model. Instead of a large upfront payment, you’ll usually pay a monthly or annual subscription fee. While this might seem like an ongoing expense, it often works out to be more affordable over time. There’s no need to invest in expensive hardware, and updates are included in your subscription.

For small businesses, this predictable pricing structure can make budgeting much easier.

Security: How Do They Compare?

Security is a valid concern when it comes to managing financial data. Traditional accounting systems rely on physical and local digital security. While this can feel reassuring, it also means your data is vulnerable to theft, hardware failures, or natural disasters.

Cloud-based accounting providers, on the other hand, take security very seriously. They use encryption to protect your data, both in transit and at rest. Regular backups ensure that even if something goes wrong, your information is safe. Plus, with multi-factor authentication and role-based access, you can control who has permission to view or edit your financial records.

Does this mean cloud-based systems are 100% foolproof? Of course not. No system is. But for many businesses, the added security measures and off-site backups offered by cloud platforms provide peace of mind that traditional systems can’t match.

Ease of Use and Collaboration

When it comes to user-friendliness, cloud-based accounting often comes out on top. These platforms are designed with modern users in mind, offering intuitive dashboards and automation features that simplify repetitive tasks. For example, many cloud systems can automatically categorize expenses or generate financial reports, saving you hours of manual work.

Collaboration is another area where cloud platforms shine. With traditional accounting, sharing files with your accountant or team members can be cumbersome. You’re often stuck emailing files back and forth, which is not only time-consuming but also increases the risk of version control issues.

With a cloud-based system, everyone works from the same data in real time. Need your accountant to review your books? They can log in remotely and see the exact same numbers you’re looking at. This level of collaboration can streamline your workflow and reduce errors.

Which Should You Choose?

Deciding between traditional and cloud-based accounting ultimately depends on your needs. If your business operates in a highly secure environment with limited internet access, traditional methods might make more sense. But for most businesses—especially small ones—the flexibility, affordability, and convenience of cloud-based accounting are hard to beat.

Think about what matters most to you. Is it being able to work from anywhere? Do you want to save time by automating routine tasks? Or is cost your top priority? Answering these questions can help you make the right choice.

Moving Forward with Confidence

Switching to a new accounting system can feel like a big leap, but it’s also an opportunity to improve how you manage your business. Whether you stick with traditional methods or embrace cloud-based technology, the key is to choose a system that works for you—not the other way around.

Ready to explore your options? Take your time, weigh the pros and cons, and make the choice that fits your business’s unique needs. After all, accounting isn’t just about numbers—it’s about building a foundation for growth.