Unifin Debt Collector Text How to Verify, Avoid Scams, and Protect Your Rights

When I first learned how debt collectors like Unifin operate, I realized how easily a simple text message could cause confusion, stress, and even financial harm if handled the wrong way. Over the years, I’ve helped many people navigate these situations, and one thing has become clear: the key is to stay calm, informed, and in control. A Unifin debt collector text isn’t just another notification on your phone; it’s a communication that could affect your credit, your finances, and your peace of mind.

In this guide, I’ll share the exact steps I recommend to verify if the text is real, protect your personal information, and respond in a way that safeguards your rights. Whether the debt is valid or a mistake, you’ll learn how to handle it with confidence, avoid scams, and make decisions that put your financial well-being first.

What Is a Unifin Debt Collector Text?

A Unifin debt collector text is a message you might get on your phone from Unifin, a company that collects debts on behalf of other businesses or after buying old debts. The text usually tells you that you owe money and asks you to contact them to discuss payment. Sometimes, it might include an account number, the amount you supposedly owe, or a link to a website.

These texts can appear out of the blue, even if you have never heard of Unifin before. This is because many debt collectors buy accounts from banks, credit card companies, or service providers when payments have been missed for a long time. They might also contact the wrong person if their records are outdated or incorrect.

Getting this type of message can be stressful, especially if you are not sure whether it is real. Some are genuine, but others can be scams pretending to be from Unifin to trick you into paying money or giving personal information. The safest approach is to avoid clicking any links and confirm directly with Unifin through their official phone number or website before taking any action.

Why You Might Get a Text from Unifin

There are a few reasons why you might receive a text from Unifin. The most common is that you have an unpaid bill or debt that has either been sent to collections or sold to Unifin by the original creditor. This could be from a credit card, personal loan, medical bill, or even a utility account you once had. Sometimes, these texts are sent because of an error. Your phone number might have been linked to someone else’s account, or the debt could belong to another person with a similar name. Old debts can also get mixed up in records, leading to mistaken messages.

Another possibility is that Unifin debt collector text bought a batch of overdue accounts from another company, and your information was included in that purchase. Debt collectors often reach out quickly after acquiring accounts, which is why the message may feel sudden or unexpected. Even if you do owe the debt, the text might not contain all the details you need to confirm it. That’s why it’s important not to make any payments or share personal information until you’ve verified that the debt is truly yours and that the message is genuinely from Unifin.

Is the Unifin Debt Collector Text Real or a Scam?

Not every text that says it’s from Unifin is genuine. Some are real attempts to collect a valid debt, but others are scams designed to steal your money or personal information. Knowing the difference can save you from big problems. A legitimate Unifin debt collector text will usually include your name, details about the debt, and clear instructions on how to contact them through official channels. It should not pressure you into making an immediate payment without giving you the chance to verify the debt.

Scam texts, on the other hand, often feel rushed and threatening. They might demand instant payment, use aggressive language, or include suspicious links. Some will ask for sensitive information like your Social Security number, bank details, or credit card number, which a legitimate collector should never request through text. The safest way to check is to avoid clicking on any links in the message. Instead, look up Unifin’s official contact information and call them directly. Give them any reference number in the text and ask if it matches their records. If they can’t confirm it, or if they tell you they didn’t send the message, it’s likely a scam.

Keeping Your Personal Information Safe from Debt Collection Scams

When you get a message, email, or call from someone claiming to be a debt collector, protecting your personal information should be your first priority. Scammers often pretend to represent companies like Unifin to trick people into giving away details such as Social Security numbers, bank account information, or credit card details.

Never share sensitive information through text messages, social media, or unsecured websites. A legitimate debt collector should not ask for full personal or banking details through these channels. If they need verification, they will guide you to a secure and official method.

Always verify the debt before discussing payment. This means contacting the company directly through their official website or phone number, not through the contact information in the suspicious message. Keep records of all your communications, including dates, times, and what was said. By staying alert, verifying messages, and refusing to share private details without confirmation, you can protect yourself from falling victim to scams that aim to steal your money or identity.

What to Do When You Receive the Text

If you get a text from Unifin, the most important thing is not to panic or react too quickly. Take a moment to read the message carefully and look for any details that could help you confirm whether it’s real. Do not click on any links or reply right away. Scammers often use links to steal personal information or install harmful software on your phone. Instead, note down any reference numbers, dates, or amounts mentioned in the text.

Next, find Unifin’s official contact details on their website or from a trusted source. Call or email them directly, and ask them to verify if the text you received is genuine. If they confirm it, request a written notice of the debt. This is your legal right and will give you full details, such as the original creditor and the amount owed.

If you believe the debt is not yours or the text is a mistake, tell them in writing and ask them to stop contacting you. Keep copies of all messages, letters, and notes from phone calls in case you need to prove your side later. Acting calmly and methodically protects you from scams and ensures you don’t accidentally admit to or pay a debt you don’t owe.

Why Debt Collectors Send You Text Messages

Debt collectors, including companies like Unifin, often use text messages because it’s a quick and inexpensive way to reach people. With most people keeping their phones nearby, texting increases the chances that you will see the message compared to a letter or even a phone call. Some collectors send texts to provide reminders about overdue payments, while others use them as an initial contact to encourage you to call or visit their website. In some cases, they may also send texts to follow up on earlier letters or calls that went unanswered.

The shift to texting is partly because of changes in technology and communication habits. Many people prefer text messages over phone calls, so collectors adapt to reach debtors in the way they’re most likely to respond. However, even if texting is convenient, it’s important to remember that scammers also use this method. That’s why you should never share personal or financial information through a text message without first verifying the sender’s identity.

Consequences of Ignoring a Unifin Debt Collector Text

Ignoring a Unifin debt collector text might seem like the easiest way to avoid stress, but it can lead to bigger problems over time. If the debt is legitimate, not responding means it may continue to grow because of interest or late fees. The collector may also try other ways to contact you, such as phone calls, letters, or even reaching out to your workplace in some situations allowed by law.

In some cases, unpaid debts can be reported to credit bureaus, which can lower your credit score and make it harder to get loans, rent an apartment, or even secure certain jobs. If the debt remains unresolved, the collector may take legal action, which could result in a court judgment against you. Even if you believe the debt is not yours, ignoring the text won’t make it disappear. Instead, it’s better to verify the claim and, if needed, dispute it in writing. This way, you protect your rights and avoid potential damage to your credit and finances.

How to Access the Unifin Debt Collector Login Safely

If you need to manage your account or make a payment online, Unifin offers a secure login portal on their official website. This portal lets you view your balance, check payment history, and update your contact details without needing to call their office. To access it safely, avoid clicking on any login links sent through text messages or emails, as these could lead to fake websites created by scammers. Instead, open your browser and type in Unifin’s official web address yourself, or find it through a trusted source like the Better Business Bureau.

Once on the official site, look for the login section. You’ll usually need your account or reference number, along with other identifying details, to sign in. Always make sure the website address starts with “https://” and shows a padlock icon in the browser bar, which indicates a secure connection. If you have trouble logging in, contact Unifin directly using their verified phone number rather than searching for help links online. This ensures you’re getting accurate guidance and keeps your account information safe from potential fraud.

Unifin Debt Collector Text Verification Online

If you receive a text claiming to be from Unifin, one of the safest ways to check if it’s real is by verifying it through Unifin’s official website. Start by ignoring any links included in the message, as scammers often use fake websites that look real to trick people into giving out personal details.

Instead, open your browser and type in Unifin’s official web address yourself or find it through a trusted source like the Better Business Bureau. Once you are on their site, look for their contact page or any section where you can verify account information. You can then reach out to their customer service using the phone number or email address listed there.

When you contact them, provide the reference number or account details mentioned in the text. They should be able to confirm if the message was sent by them and whether the debt information is accurate. If they can’t find a match in their system, that’s a strong sign the text may be a scam. Verifying directly through Unifin’s website protects you from clicking unsafe links and gives you peace of mind before taking any further steps.

Unifin Debt Collector Reference Number Guide

When you receive a message or letter from Unifin, you will often see a reference number included. This number is unique to your case and helps Unifin quickly locate your account details when you contact them. It acts like a tracking ID for your debt file, making communication faster and reducing the chance of mix-ups.

If you decide to call or email Unifin, having this reference number ready will make the process smoother. It also helps ensure you are discussing the correct account, especially if you have had multiple loans or bills in the past. Without it, the representative may have to search for your personal information, which can take longer.

Always double-check that the reference number in the message or letter matches the one Unifin provides when you verify your account. If it doesn’t match, it could mean the communication is a scam or sent to you by mistake. Keep your reference number private and do not share it with anyone other than Unifin’s verified customer service team. This protects your account from being used for fraudulent purposes.

Understanding Your Unifin Debt Collector Letter

A Unifin debt collector letter is a formal notice sent to inform you about an outstanding debt they believe you owe. This letter usually arrives by mail and contains more detailed information than a text message. It will typically include your name, the original creditor’s name, the total amount owed, and instructions on how to respond or make payment.

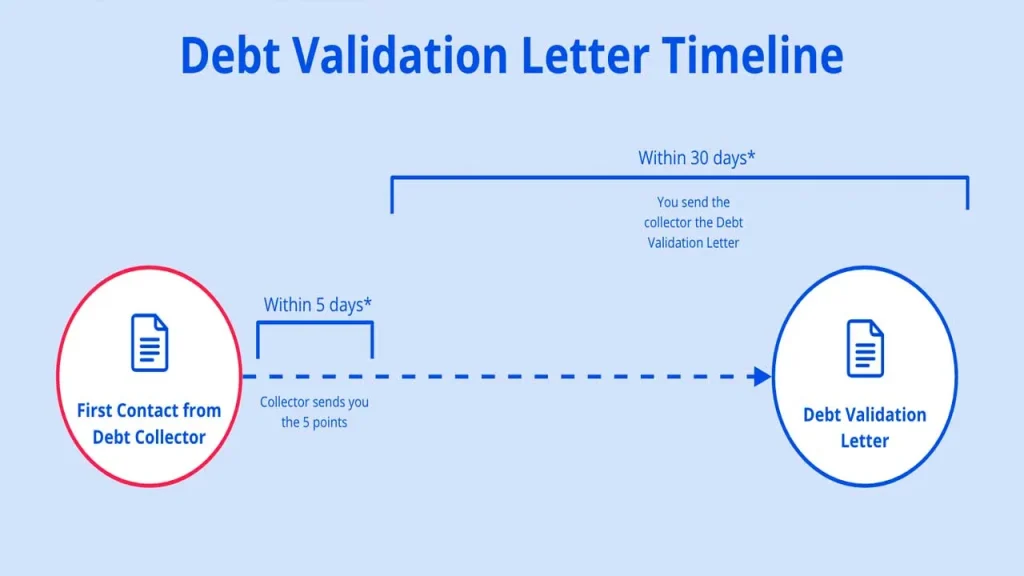

Receiving this letter can feel intimidating, but it’s important to remember that it’s part of the debt collection process and also a legal requirement. Debt collectors must send a written notice within a certain time after first contacting you, so you have a clear record of the claim.

When you get this letter, read it carefully. Check for any errors in the amount, the creditor’s name, or your personal information. If something doesn’t seem right or you don’t recognize the debt, you have the right to request verification. This means Unifin must provide proof that the debt belongs to you and that they are authorized to collect it. Keeping the letter in a safe place is important for your records, even if you believe it’s a mistake. It can serve as evidence if you need to dispute the debt or file a complaint later.

Do You Need to Pay Unifin Debt Collector

Whether you need to pay Unifin depends on a few key factors. First, you should confirm that the debt is truly yours. Sometimes, debts are sent to the wrong person because of outdated records or similar names. You have the right to request proof, known as debt validation, before making any payment.

If the debt is legitimate and still within the legal time limit for collection, paying it can stop further collection efforts and prevent additional damage to your credit. However, if the debt is very old, it might be past the statute of limitations in your state, meaning they can no longer sue you to force payment, though they may still try to collect.

It’s important to get everything in writing before sending money. Make sure you understand the total amount owed, any fees, and how the payment will be reported to credit bureaus. If you cannot pay in full, you might be able to negotiate a settlement or payment plan. Paying the right debt after proper verification can protect your credit and give you peace of mind, but paying without checking could waste your money on a debt that isn’t actually yours.

How to Stop Unwanted Unifin Text Messages

If you keep getting texts from Unifin and you don’t want them, start by confirming if the messages are real or scams. Scam texts should be blocked on your phone right away, and you can report them to your mobile carrier or the Federal Trade Commission (FTC). Avoid clicking any links or replying, as this can confirm to scammers that your number is active.

If the messages are legitimate but you prefer not to be contacted by text, send a written request to Unifin asking them to stop. Many debt collection laws require them to honor your request and only contact you through mail. You can also adjust your communication preferences by logging into your account on Unifin’s official website and disabling text notifications. This way, you control how you receive important information without unwanted interruptions.

Your Rights Under Unifin Debt Collection Laws

When dealing with a Unifin debt collector text or letter, you have legal rights designed to protect you from unfair treatment. In the United States, these rights are outlined in the Fair Debt Collection Practices Act (FDCPA). This law requires debt collectors, including Unifin, to treat you fairly and provide accurate details about any debt they are trying to collect.

Under these rules, Unifin must give you clear information about the debt, such as the name of the original creditor and the amount owed. You have the right to request written verification within 30 days of receiving the first Unifin debt collector text or call. Until they provide proof, they must pause collection efforts. You are also protected from harassment, threats, or being contacted at unreasonable hours, and they cannot discuss your debt with anyone other than you or your attorney.

Understanding your rights when you receive a Unifin debt collector text gives you the confidence to respond carefully and avoid being pressured into paying a debt that may not be yours. If you believe Unifin or any other collector has violated these laws, you can report them to the Consumer Financial Protection Bureau (CFPB), the FTC, or your state attorney general’s office.

Conclusion

Receiving a Unifin debt collector text can be stressful, but knowing your rights and taking the right steps can protect you from mistakes and scams. Always verify that the text is genuine before sharing any personal or financial details. Use official Unifin channels to confirm the debt, request written proof, and keep clear records of all communication.

If the debt is valid, address it quickly to avoid further damage to your credit; if it’s not, dispute it in writing. Staying calm, informed, and cautious ensures you remain in control of the situation. By handling a Unifin debt collector text the right way, you protect both your finances and your peace of mind.